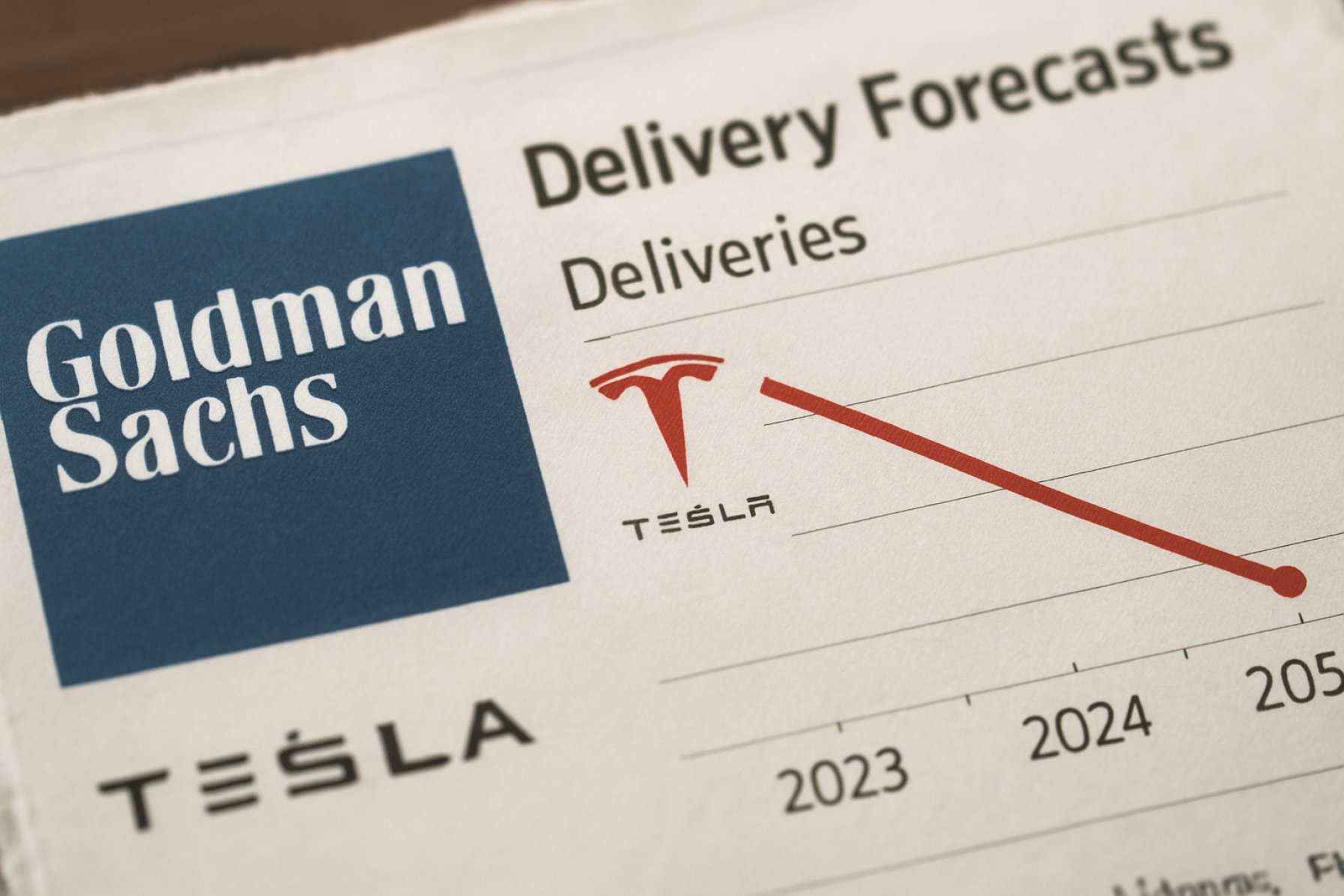

Tesla Faces Turbulence: Goldman Sachs Cites Weak Demand and Drops 2025 Delivery Targets

Goldman Sachs cuts Tesla’s 2025 outlook as global demand slips. Find out what’s driving the downturn and what investors should watch now.

- 2025 Delivery Forecast: 1.575 million units—down from 1.78 million

- Q2 2025 Estimate: 365,000 vehicles—12% lower than consensus

- Chinese Market: 20% year-over-year drop between April and May

- Updated Price Target: $285 per share (was $295)

Staggering new data has shaken Tesla’s growth story. Investment titan Goldman Sachs just took an axe to its delivery expectations for the electric vehicle (EV) trailblazer—citing sharp regional slowdowns, brand issues, and faltering consumer demand.

Both U.S. and European sales are lagging, while China, typically a bright spot for Tesla, is also showing troubling signs. The impact? Investors and industry watchers are bracing for a rougher ride ahead.

Why Did Goldman Sachs Downgrade Ferrari-Like Tesla Forecasts?

Analysts at Goldman Sachs studied monthly registration and delivery stats—and the data sent shockwaves across Wall Street. In the U.S., Tesla deliveries through May are down by “mid teens percent” year-over-year, according to industry sources like Wards and Motor Intelligence.

Across the Atlantic, Europe’s numbers fared even worse: April registrations crashed by 50% compared to 2024, and preliminary May data hints at a “mid 20%” annual drop. China, the world’s largest EV market, offers only a small relief—with a sequential bump, but a 20% decline over last year.

Digging deeper, consumer surveys tracked by firms like Morning Consult and HundredX revealed “weak sentiment” for Tesla in both North America and Europe. Chinese buyers, however, still favour the brand, keeping demand slightly stronger there.

Q&A: What’s Behind the Drop?

Q: Why are Tesla’s deliveries falling in the U.S. and Europe?

A: Goldman Sachs pointed to weakening demand, negative brand sentiment, and stiffer competition. Consumers are hesitating—and rivals are pouncing.

Q: Is China any different?

A: While Chinese consumers remain more positive, escalating competition and poor timing in Tesla’s product cycle are limiting any serious gains.

Q: Will incentives like price cuts help?

A: Goldman Sachs notes Tesla may resort to more aggressive incentives—but warns this could compress profit margins and signal deeper demand issues.

How Will Tesla’s New 2025 Forecasts Shake Up the EV Market?

Goldman Sachs now expects Tesla to deliver:

- 1.575 million vehicles in 2025

- 1.865 million in 2026

- 2.15 million in 2027

Those projections are all notably lower than previous estimates. For Q2 2025, deliveries could range between just 335,000 and 395,000 vehicles—far below analyst consensus of 417,000. This revised guidance could spook investors and fuel uncertainty across the wider stock market.

Despite the gloom, Goldman Sachs stood by their “Neutral” rating for Tesla shares, tweaking the 12-month price target down to $285, from $295. Still, they remain cautious—and so should investors tracking the electric juggernaut.

For more on global finance trends, check sites like Investing.com or Bloomberg.

How Should Investors React Right Now?

Keep eyes peeled for Tesla’s Q2 numbers and watch for fresh demand signals, especially any signs of big price cuts or ramped-up incentives. Follow industry sites like Reuters for updates on Tesla and EV competitors.

Be ready for volatility—and readjust your portfolio if these trends grow more alarming.

Ready to navigate Tesla’s new reality? Stay proactive. Review these steps now:

- Track Tesla’s official Q2 delivery reports closely

- Monitor U.S., European, and Chinese market sales trends

- Watch for new incentives or price cuts—and what that does to margins

- Stay tuned to credible news outlets for breaking updates

- Consider rebalancing EV-related investments if headwinds persist

The EV market is evolving fast. Don’t get left behind—stay informed and act decisively!